Money Doesn't Have to Be Complicated

Most business owners get stuck because finance feels like another language. We break it down into plain English so you can actually make decisions that matter. Starting September 2025, we're teaching practical finance skills that work in real Australian businesses.

View Program Details

What Actually Gets Covered

Look, we're not trying to turn you into an accountant. That's their job. But you should know enough to spot problems before they become disasters and understand what your numbers are really telling you.

The program runs through autumn 2025, and we focus on things that come up in actual businesses. Cash flow management that doesn't require a finance degree. How to read your P&L without falling asleep. Basic forecasting that helps you plan ahead instead of constantly reacting.

- Understanding cash flow patterns in your specific industry

- Reading financial statements without panic

- Building budgets that you'll actually use

- Making sense of GST and tax obligations

- Spotting warning signs before they become real problems

We've worked with everyone from tradies to consultants to small manufacturers. The fundamentals stay the same, but how you apply them changes based on what you're actually doing.

How We Teach This Stuff

Forget sitting through endless PowerPoint slides. Each session works through real scenarios from Australian businesses. Sometimes they're sanitized versions of our clients' situations. Sometimes they're problems we've seen come up again and again.

You'll work on your own numbers too. Bring your actual financials and we'll help you make sense of them. That's where the learning actually happens – when you're looking at your own business instead of theoretical examples.

Classes meet once a week for three hours. Usually Wednesday evenings, starting at 6:30pm, because that seems to work for most people running businesses during the day. You can join remotely if you need to, though the in-person sessions tend to generate better discussions.

One participant last year mentioned they finally understood why their accountant kept bringing up certain issues. That's exactly what we're going for – better conversations with your financial advisors, not replacing them.

What People Actually Say

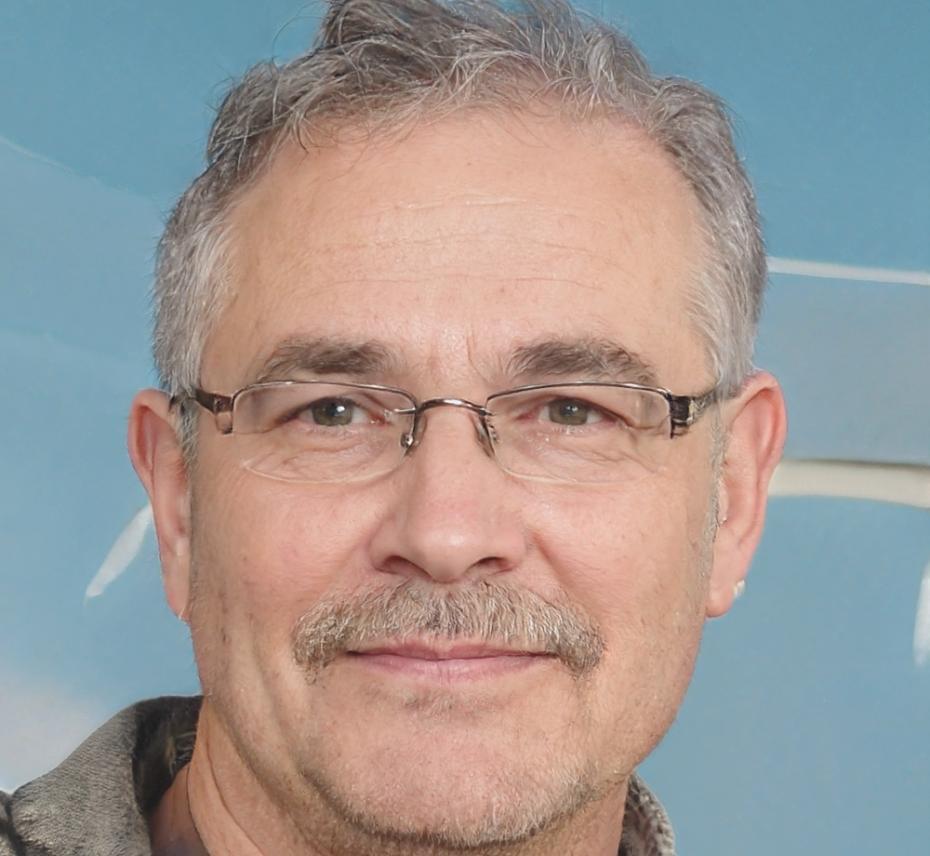

Darren Blackwood

Construction Business Owner

I'd been running my construction company for six years and still felt like I was guessing half the time. The program helped me understand what my cashflow forecasts were actually showing me. Now I can spot problems a month or two out instead of when they hit my account. Would've saved me a lot of stress if I'd done this earlier.

Our next cohort starts in September 2025. We keep groups small – usually around 15 people – so there's space to ask questions and work through your specific situation.

Ready to Get Started?

Program information and enrolment details are available now. We're taking registrations through July 2025 for the September intake.

Get in Touch